Unleashing the Potential of Trading Forex Robots

In the fast-paced world of Forex trading, where every second counts, more traders are turning to technology for assistance. A viable solution that has gained traction in recent years is the use of trading Forex robots. These automated systems not only streamline trading processes but also provide opportunities for traders to maximize their profits with minimal effort. Companies like trading forex robot Global Web Trading have emerged to assist traders in understanding and utilizing these innovative tools.

What is a Forex Robot?

A Forex robot, commonly referred to as an Expert Advisor (EA), is a software program designed to execute trades on behalf of a trader. These robots analyze market data and execute trades based on predefined criteria, allowing them to make decisions faster than a human trader could. The underlying algorithm often employs technical analysis and a variety of indicators to identify potential trade opportunities.

The Advantages of Using Forex Robots

There are several advantages to using Forex trading robots, making them an attractive option for both novice and experienced traders:

- Emotionless Trading: One of the most significant advantages of using Forex robots is their ability to trade without emotion. Human traders often make decisions based on fear or greed, which can lead to losses. In contrast, robots follow a strict algorithm, ensuring that trades are executed based on logic rather than emotion.

- 24/7 Trading: Forex markets operate around the clock. While human traders need to rest, Forex robots can monitor the markets and execute trades at any time of day or night. This constant supervision can lead to more trading opportunities and increased profits.

- Backtesting: Traders can backtest their strategies using historical data to assess the efficacy of their strategy before committing real money. This evaluation helps in refining strategies to enhance the prospect of success.

- Consistency: Forex robots adhere to set trading rules and parameters without deviation, ensuring that the trading strategy is consistently applied over time.

How to Choose a Reliable Forex Robot

Given the plethora of automated trading options available, selecting a reliable Forex robot can be challenging. Here are several factors to consider when choosing the right robot:

- Reputation and Reviews: Before investing in a Forex robot, conduct thorough research. Look for reviews and testimonials from other traders to gauge the robot’s performance and reliability.

- Transparency: A trustworthy Forex robot provider will be transparent about its algorithms and performance. Avoid robots that do not disclose their strategies or provide vague information.

- Demonstration or Trial Period: Many reputable Forex robots offer a trial period or demo account. This feature allows potential users to test the robot’s performance in a risk-free environment.

- Customer Support: Reliable customer support is essential, especially when trading with automated systems. Choose a provider with responsive support channels to assist with any inquiries or issues you may face.

Common Misconceptions About Forex Robots

As with any technological advancement, misconceptions surround Forex robots. Here are a few common myths:

- Forex Robots Guarantee Profits: While Forex robots can enhance trading efficiency and profitability, they do not guarantee success. Market conditions can change rapidly, and even the most sophisticated algorithms may incur losses.

- They Require No Monitoring: Although robots can operate independently, they still need some level of oversight. Market conditions can shift unexpectedly, and human intervention may be necessary to adjust parameters or strategies.

- They Are Only for Experienced Traders: Forex robots can be utilized effectively by traders of all experience levels. However, it’s essential to understand how they work to maximize their potential benefits.

Setting Up Your Forex Robot

Once you’ve selected a suitable Forex robot, the next step is setting it up. Here are some essential steps to get started:

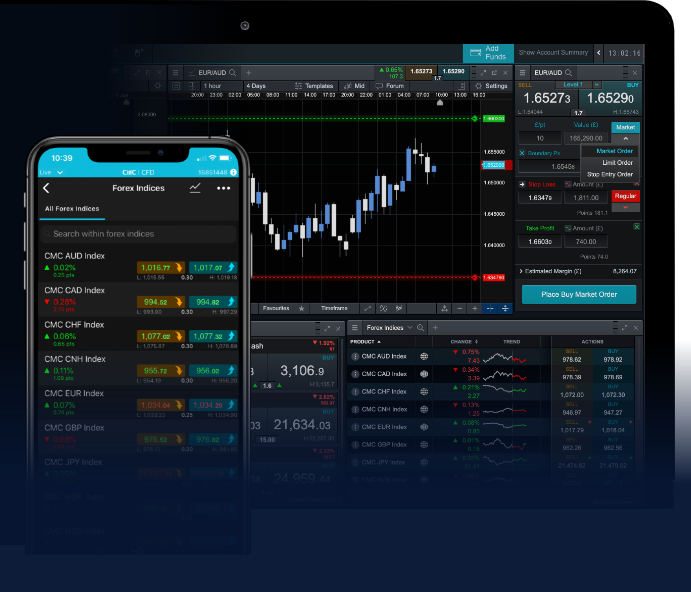

- Install Trading Platform: Most Forex robots operate through popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Ensure you have the necessary software installed on your computer or device.

- Configure Settings: After installation, configure the robot settings based on your trading strategy. This includes parameters such as risk management, lot sizes, and stop-loss settings.

- Run Backtests: Before trading with real money, run backtests on historical data to evaluate the robot’s performance. Make any adjustments necessary based on the outcomes.

- Start Live Trading: Once you are satisfied with the backtest results, you can proceed to live trading. It’s advisable to start with a demo account to minimize risks and familiarize yourself with the robot’s behavior in real-time.

Conclusion

Trading Forex robots represent an innovative way to leverage technology in the dynamic Forex trading landscape. While they offer numerous benefits, it’s crucial to approach them with a balanced perspective, understanding both their potential and limitations. By choosing the right robot, conducting thorough research, and maintaining oversight, traders can harness the power of automation to improve their trading strategies. As the financial markets continue to evolve, embracing tools like Forex robots may well become an essential part of a trader’s toolkit.